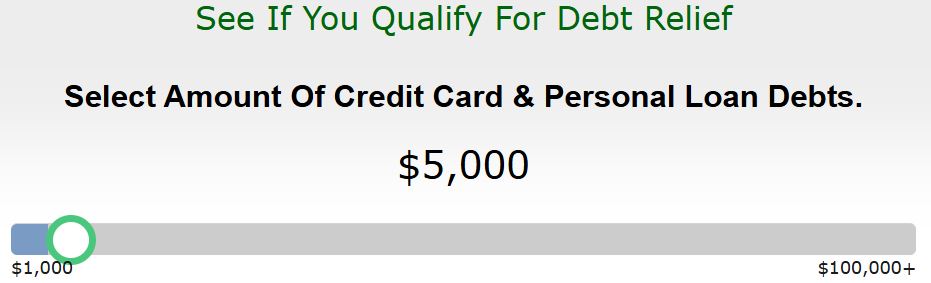

Lower Your Unsecured Debt

If you have $5,000+ in credit card or personal loan debt, a free consult can review options like settlement or hardship plans.

Love our content? Show your support by following us — pretty please!🥺

FOLLOW ON PINTEREST

Hi! I’m Kate, the face behind KateFi.com—a blog all about making life easier and more affordable.

- One-on-one call to review your debts and goals

- See potential monthly payment reductions

- No obligation to enroll

Not available in IL, KS, OR, TN, UT, WV.

The Long-Term Impact of Debt on Your Financial Health

Debt can weigh heavily on your financial health, not just in the immediate sense but over the long term. As you navigate through financial obligations, it’s vital to understand how debt affects your financial health and the potential relief options available to you. In this guide, we’ll provide a step-by-step roadmap on managing your debt, discuss common pitfalls like scams, and emphasize the importance of exploring legitimate relief solutions.

Understanding the Burden of Debt

Before diving into solutions, it’s crucial to comprehend the long-term impacts of debt. High levels of debt can result in a poor credit score, increased stress, and limited financial freedom. You may find it challenging to secure loans for big purchases like a house or a car, or even be unable to qualify for certain jobs that perform credit checks.

The impacts of debt can include:

- High-interest payments: This means a significant portion of your income goes toward paying off interest rather than the principal.

- Stress and mental health issues: Ongoing debt can lead to anxiety and stress, affecting your overall well-being.

- Limited opportunities: With high debt, you may miss out on investment opportunities or the ability to save for retirement.

Understanding these consequences can motivate you to take action to regain control of your finances.

Exploring Debt Relief Options: A Step-by-Step Roadmap

When it comes to tackling debt, several options exist. Below is a simple decision tree that can guide you in choosing the right path for your situation:

- Assess Your Debt:

- List out all your debts, including balances, interest rates, and minimum payments.

- Calculate your total monthly income and expenses to understand your cash flow.

- Evaluate Your Financial Situation:

- Do you have a stable income?

- Are you facing financial hardship?

- Do you have any assets to consider?

- Consider Your Options:

A. Debt Settlement

- Involves negotiating with creditors to pay a lump sum that’s less than what you owe.

- Best for those who have a significant amount of debt and can afford a one-time payment.

- May negatively impact your credit score.

B. Debt Management Plan (DMP)

- A structured plan where you make a single monthly payment to a credit counseling agency, which then pays your creditors.

- This option often has lower interest rates and waives fees.

- Less harmful to your credit score compared to settlement.

C. Debt Consolidation

- Combines multiple debts into one loan with a lower interest rate.

- Good for those with high-interest debt who want to simplify their payments.

- Can help maintain or improve your credit score if managed correctly.

#### Comparison Table of Debt Relief Options

| Option | Impact on Credit | Monthly Payment | Timeframe | Best for |

|---|---|---|---|---|

| Debt Settlement | Negative | Variable | Short-term | Large debts, one-time payment |

| Debt Management Plan | Minimal | Fixed | Medium-term | Structured payment plan |

| Debt Consolidation | Minimal to Positive | Fixed | Variable | High-interest debt |

How to Avoid Common Debt-Relief Scams

While the prospect of finding relief from your debt is appealing, the industry is fraught with scams that promise much but deliver little. Here’s how to protect yourself:

- Beware of Upfront Fees: Legitimate companies should not require large upfront payments. Always read the fine print.

- Check Credentials: Verify if the company is accredited by a credible organization like the National Foundation for Credit Counseling (NFCC).

- Look for Transparency: A reputable company will clearly explain the services they provide and any potential risks involved.

- Do Your Research: Online reviews and Better Business Bureau ratings can help identify potential scams.

- Get a Free Consultation: Before making any decisions, consider getting a free consultation to review your options thoroughly.

Gathering Documents for a Faster Review

To expedite the process when seeking debt relief options, it’s advisable to gather specific documentation. This will also provide a clearer picture of your financial situation:

- Recent pay stubs or income statements

- Monthly bills (credit cards, loans, utilities)

- Bank statements for the last three months

- Tax returns from the previous year

- Any relevant debt collection notices

Having these documents ready will facilitate a faster review, helping you to understand your eligibility for various programs.

The Impact on Your Credit Score

Your credit score is a vital component of your financial health. Debt relief methods can affect it differently:

- Debt Settlement: May cause a significant drop in your score, especially if payments are missed before settlement.

- DMP: Typically has less impact on your credit, as you’re paying off your debts through a structured plan.

- Debt Consolidation: Can improve your score over time if you manage the new loan responsibly.

As a part of your debt relief journey, it’s important to monitor your credit regularly and make timely payments on any new agreements.

Taking the Next Step

Now that you’re aware of the impacts of debt and the various relief options available, it’s time to take action. Regardless of the route you choose, it’s essential to engage with professionals who can guide you through the process.

Consider starting with a free consultation to assess your situation and explore legitimate debt relief solutions.

✅ See If You Qualify for Debt Relief

Conclusion

The long-term impact of debt on your financial health is significant and requires thoughtful navigation. By understanding the available options, staying vigilant against scams, and seeking legitimate assistance, you can regain control over your finances. Remember, taking the first step by reaching out for help is often the most crucial move you can make on your journey to financial stability.

As you embark on this journey, don’t hesitate to get a free consultation to explore the best options tailored to your specific needs.

Important: This content is for education only—not legal, tax, or financial advice. Results and eligible programs vary by situation and state. Fees apply if you enroll and complete a program. Debt relief can affect credit; missed payments may lead to collections/lawsuits. Not available in IL, KS, OR, TN, UT, WV.

Understand pros/cons of settlement vs consolidation vs DMP for your exact mix of debts.

Not available in IL, KS, OR, TN, UT, WV.