How to Find the Right Debt Relief Program for Your Unique Needs

Finding the right debt relief program can feel overwhelming, especially when you’re already dealing with the stress of financial struggles. With various options available, it’s essential to understand which path is best suited to your situation. This guide will walk you through the different debt relief strategies, providing you with a step-by-step roadmap and decision-making trees to help you identify your best option.

Love our content? Show your support by following us — pretty please!🥺

FOLLOW ON PINTEREST

Hi! I’m Kate, the face behind KateFi.com—a blog all about making life easier and more affordable.

In addition, we’ll discuss when bankruptcy consultations make sense, helping you make informed decisions about your financial future. And don’t forget, you can always get a free consultation to explore your options.

Understanding Debt Relief Options

Understand pros/cons of settlement vs consolidation vs DMP for your exact mix of debts.

Not available in IL, KS, OR, TN, UT, WV.

Before diving into specific programs, it’s crucial to understand the various avenues available for debt relief. Below are three main types of debt relief strategies:

- Debt Settlement

- Debt Management Plans (DMP)

- Debt Consolidation

Each option comes with its advantages and disadvantages, and your unique financial situation will determine which is best for you.

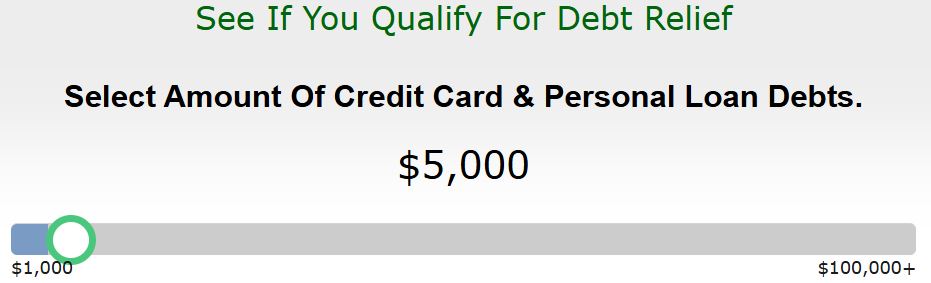

✅ See If You Qualify for Debt Relief

Step 1: Evaluating Your Debt Situation

👉 Start Your Free Debt Relief Review

Not available in IL, KS, OR, TN, UT, WV.

Before making any decisions, gather all relevant documents regarding your debt. This will not only expedite the consultation process but also provide you with a clearer picture of your financial situation. Here’s a quick checklist of documents to prepare:

- Credit card statements

- Loan agreements

- Pay stubs and tax returns

- Bank statements

- Any collection notices

Next, calculate your total debt and monthly expenses to determine how much you can afford to pay.

Step 2: Choose a Debt Relief Strategy

Now that you’ve gathered your information, it’s time to explore the three primary debt relief options.

Debt Settlement

Debt settlement involves negotiating with creditors to reduce the total amount of debt you owe. Typically, this is done by a third-party company that will negotiate on your behalf. Here are some pros and cons:

| Pros | Cons |

|---|---|

| Can significantly reduce the amount owed | May negatively impact your credit score |

| Less time-consuming than a DMP | Not all creditors will negotiate |

| Can provide quick relief | Fees apply for settlement services |

If you have a significant amount of debt and are struggling to make payments, this might be an option worth considering.

Debt Management Plans (DMP)

A Debt Management Plan is typically organized through a credit counseling agency. You make one monthly payment to the agency, which then distributes it to your creditors. Here are some pros and cons:

| Pros | Cons |

|---|---|

| Helps manage multiple debts with one payment | Could take 3-5 years to complete |

| May lower interest rates on debts | Requires commitment to a structured plan |

| Less impact on credit than debt settlement | You may have to close credit accounts |

DMPs are often suitable for individuals who want to pay off their debt fully without settling or declaring bankruptcy.

Debt Consolidation

Debt consolidation involves taking out a new loan to pay off existing debts, consolidating them into one single payment. Here are some pros and cons:

| Pros | Cons |

|---|---|

| Simplifies payments | Requires good credit to secure favorable terms |

| Potentially lowers interest rates | Not a solution for underlying financial issues |

| Quick access to funds | Could lead to further debt if not managed properly |

If you have a steady income and can qualify for a loan, debt consolidation might be the way to go.

✅ See If You Qualify for Debt Relief

Step 3: Decision Tree for Debt Relief Options

To help guide your decision, here’s a simple decision tree to help you visualize your options.

- Are you struggling to make your minimum payments?

- Yes: Consider Debt Settlement or Debt Management Plans (DMP).

- No: Consider Debt Consolidation.

- Do you have significant debt (over $10,000)?

- Yes: Debt Settlement may be a viable option.

- No: Consider a Debt Management Plan (DMP).

- Do you have a steady income and good credit?

- Yes: Explore Debt Consolidation.

- No: Consider Debt Settlement or DMP.

- Are you at risk of being sued for your debt?

- Yes: It may be time to consider a bankruptcy consultation.

- No: Explore the previous options.

This simple decision tree can help clarify your options and identify the best path forward.

Step 4: When Bankruptcy Consults Make Sense

If your financial situation is dire, bankruptcy may be a viable option. Here are a few scenarios where a bankruptcy consultation could make sense:

- You have little to no disposable income.

- You are facing impending lawsuits or wage garnishments.

- Your debts far exceed your ability to repay.

- You’re experiencing significant emotional or mental stress due to your financial situation.

Keep in mind that while bankruptcy can provide a fresh start, it also comes with long-term consequences for your credit.

Consider consulting with a qualified bankruptcy attorney to understand your options better and get personalized guidance.

✅ See If You Qualify for Debt Relief

Understanding the Impact on Your Credit

Each debt relief strategy can have varying impacts on your credit score:

- Debt Settlement: This option can lower your score significantly, especially if accounts are marked as “settled” or “paid for less than owed.” However, over time, the negative impact may decrease as you work to rebuild your credit.

- Debt Management Plans (DMP): DMPs may have less of an impact on your credit score, as you’re making regular payments. However, closing accounts may affect your credit utilization ratio.

- Debt Consolidation: This option may help your credit score in the long run if you can manage the new loan and maintain timely payments. However, applying for a new loan may cause a slight dip in your score initially.

It’s important to monitor your credit report regularly and take steps to rebuild your credit, regardless of the path you choose.

Conclusion: Take Control of Your Financial Future

Finding the right debt relief program for your unique needs involves evaluating your financial situation and understanding the options available to you. From debt settlement to debt management plans and debt consolidation, each path has its pros and cons.

If you’re feeling overwhelmed or unsure where to begin, consider getting a free consultation to review your options. Remember, your financial future is worth taking the time to explore the best debt relief strategy for your needs.

Important: This content is for education only—not legal, tax, or financial advice. Results and eligible programs vary by situation and state. Fees apply if you enroll and complete a program. Debt relief can affect credit; missed payments may lead to collections/lawsuits. Not available in IL, KS, OR, TN, UT, WV.

✅ See If You Qualify for Debt Relief

By following these steps and understanding the nuances of each option, you can take meaningful steps towards financial freedom and peace of mind.